Snap Stock Set to Break Out Like SoFi, Upstart?

Published 11:31 am Friday, June 16, 2023

- Snap Stock Set to Break Out Like SoFi, Upstart?

For the first few months of the year, megacap tech stocks like FAANG, Nvidia (NVDA) – Get Free Report and Microsoft (MSFT) – Get Free Report were the only real leaders.

Now, we’ve seen better price action out of growth stocks like SoFi Technologies (SOFI) – Get Free Report, Upstart Holdings (UPST) – Get Free Report and even the ARK Innovation ETF (ARKK) – Get Free Report.

Is Snap (SNAP) – Get Free Report going to join that list? The charts are finally showing some bullish momentum, although Snap is contending with a key resistance area.

Don’t Miss: SoFi Stock Has Doubled in a Month; Here’s the Trade

Still, we’re seeing better price action out of technology and growth stocks, as well as advertising and social media firms like Trade Desk (TTD) – Get Free Report and Meta (META) – Get Free Report.

When Snap stock last reported earnings, it disappointed investors and the shares fell 17% in a single session. Five sessions later, the stock was down almost 25%.

Snap is now up almost 35% from those post-earnings lows.

Trading Snap Stock

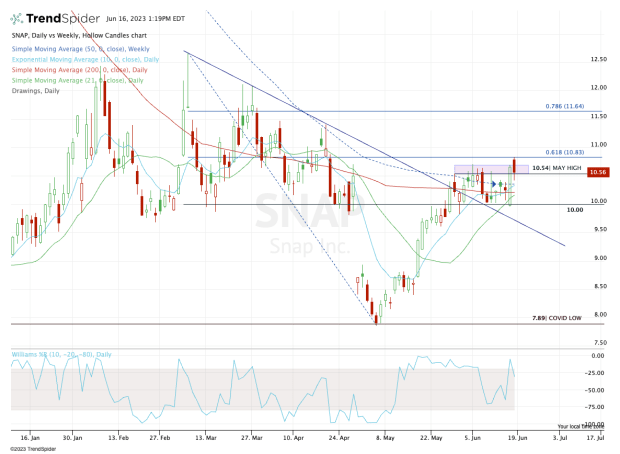

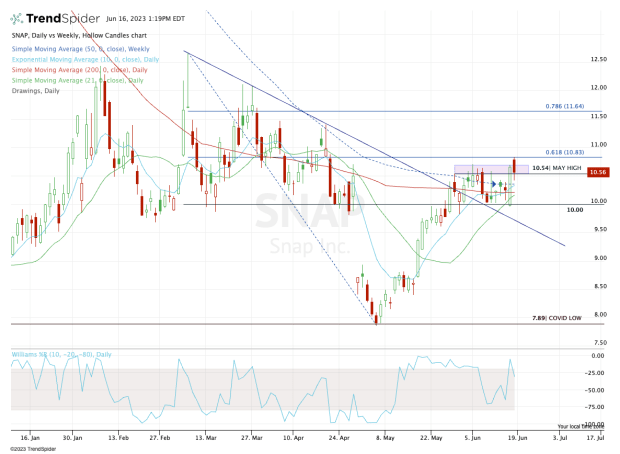

Chart courtesy of TrendSpider.com

On the earnings dip, Snap quickly made its way down toward the covid-19 low at $7.86. This level held as support, and in short order the shares climbed back to the $10 area.

The $10 level earlier had been support, so traders reasonably could have seen it becoming resistance. Instead, Snap reclaimed this mark and continued to find it as support while it consolidated between $10 and $10.75.

On Thursday Snap stock rallied 4% and cleared the May high at $10.54 in the process. On Friday, the momentum continued in the morning as the shares hit multimonth highs.

Don’t Miss: Alphabet Stock Lags in the FAANG Race. Can It Catch Up?

At last check Snap stock was less than 1% lower as it continues to struggle with the $10.75 area and the 61.8% retracement.

That leaves the stock in an interesting spot. If Snap stock can’t continue higher, the bulls must see how it handles the $10 support level and its numerous moving averages near this mark, including the 10-day, 21-day, 200-day and 50-week moving averages.

Worth noting is that Snap is set to close above its 50-week moving average on a weekly basis for the first time since October 2021.

On the upside, a move over this week’s high at $10.84 opens the door to the 78.6% retracement near $11.50. Above that and the $12 to $12.50 zone is in play.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.